Latest Blogs

-

James Jones-Tinsley: Guided Retirement Duty could be game changer

During May, the Pensions Policy Institute (PPI), sponsored by The Pensions Regulator (TPR), concluded that defined contribution (DC) pension savers – including those in SIPPs, as well as in Workplace Pensions - require more guidance when choosing suitable retirement products.

-

Lisa Webster: Overcomplicated rules are a threat

It may be more than a year since the Lifetime Allowance was formally abolished but issues are still emerging from the mess made by rushed legislation.

-

Lisa Webster: To gift or not to gift?

Since the announcement that pensions are to be included in estates for inheritance tax (IHT) purposes the question of whether those with large pension pots should be giving some funds away has become increasingly common.

Popular News

-

McFadden appointed new Work and Pensions Secretary

Veteran Labour MP Pat McFadden has been appointed the new Work and Pensions Secretary in the latest Cabinet reshuffle following the resignation of Angela Rayner on Friday.

-

Pension savers rushing to take 25% tax-free cash

Pension savers rushed to withdraw their 25% tax-free cash in unprecedented volumes in the 2024/25 financial year, according to new FCA data.

-

People want guaranteed income in retirement: survey

Two-fifths ( 39%) of pension savers say that a guaranteed income is their main priority in retirement.

-

Hargreaves and Schroders first to offer LTAFs in a SIPP

Hargreaves Lansdown has partnered with Schroders Capital to add two of its private markets long-term asset funds (LTAFs) to its platform.

-

Phoenix Group to rebrand as Standard Life

Savings and retirement group Phoenix will rebrand as Standard Life next March.

-

DB surpluses hit record £223bn in August

UK DB pension surpluses hit a record £223bn in August against long-term funding targets, according to analysis from pensions consultancy XPS.

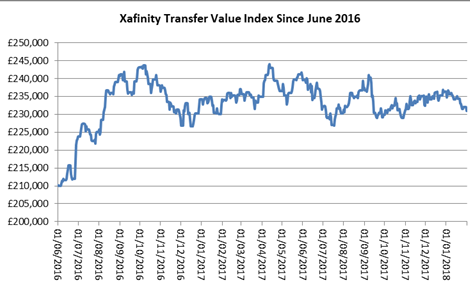

The Xafinity Transfer Value Index fell steadily from £236,000 at the end of December to £231,000 at the end of January.

Sankar Mahalingham, head of DB growth at Xafinity Punter Southall, said: “Increases in gilt yields have been the main driver, with inflation remaining relatively stable.”

Graph below courtesy of Xafinity

Screen Shot 2018 02 12 at 09.38.10

The difference between maximum and minimum readings of the index over January 2018 was £6,000 or around 2.4%, Xafinity said in a statement.

The Xafinity Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (increasing each year in line with inflation).

Different schemes calculate transfer values in different ways. A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the Xafinity Transfer Value Index.