Popular News

-

Number of appointed reps continues to fall

The number of appointed representatives continued to fall in 2024/25, according to the latest data from the Financial Conduct Authority.

-

1 in 5 pension savers mistrust financial adviser

One in five pension savers (19%) mistrust their financial adviser, according to a new report.

-

17 pension firms sign up to Mansion House Accord

A new Mansion House Accord backed by 17 pension firms aims to help DC pension savers by using private markets to boost potential net returns, while strengthening investment in the UK.

Latest Blog

-

James Jones-Tinsley: Aiming for an advice-guidance sweetspot

As Nikhil Rathi is reappointed as CEO of the Financial Conduct Authority (FCA) for another five years, the FCA has set out its strategic direction for 2025/26, with important implications for financial advisers.

-

Lisa Webster: Over-taxation of pensions remains an issue

HMRC’s January pension schemes newsletter announced changes to tax codes for pensions, and a few headlines followed proclaiming HMRC had finally fixed the over-taxation issue. It would be fantastic if that was the case, but despite nearly 10 years of getting it wrong, the problem isn’t resolved yet.

-

Lisa Webster: Divorce impact on lump sums raises question

The lifetime allowance may have been consigned to the annals of history but the various forms of protection are still relevant in the new world, especially when it comes to the amount of pension commencement lump sum (PCLS) that can be taken.

-

Martin Tilley: How education can tackle pension scams

The dark reality of pension scams is that we don’t really know how common they are. Fraud is a crime which tends to have low reporting events and with pension scams, it’s no different. The emotional toll can be as large as the financial, with some people being too embarrassed to report that they have been the victim of a scam.

-

Lisa Webster: Maximising protected tax-free cash

While 2024 ended with a lot of doom and gloom in the pension world following the big announcement on inheritance tax (IHT), there was some good news that may have slipped under the radar of some advisers.

A judge has ruled in favour of allowing investors to pursue group legal action against a SIPP firm over claims of mis-selling.

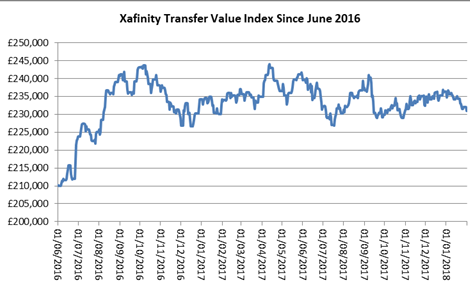

The Xafinity Transfer Value Index fell steadily from £236,000 at the end of December to £231,000 at the end of January.

Sankar Mahalingham, head of DB growth at Xafinity Punter Southall, said: “Increases in gilt yields have been the main driver, with inflation remaining relatively stable.”

Graph below courtesy of Xafinity

Screen Shot 2018 02 12 at 09.38.10

The difference between maximum and minimum readings of the index over January 2018 was £6,000 or around 2.4%, Xafinity said in a statement.

The Xafinity Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (increasing each year in line with inflation).

Different schemes calculate transfer values in different ways. A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the Xafinity Transfer Value Index.