SIPP and SSAS provider InvestAcc said revenues increased 16.3% to £10.5m in the six months to the end of December 2024, up from £9m in the same period in 2023.

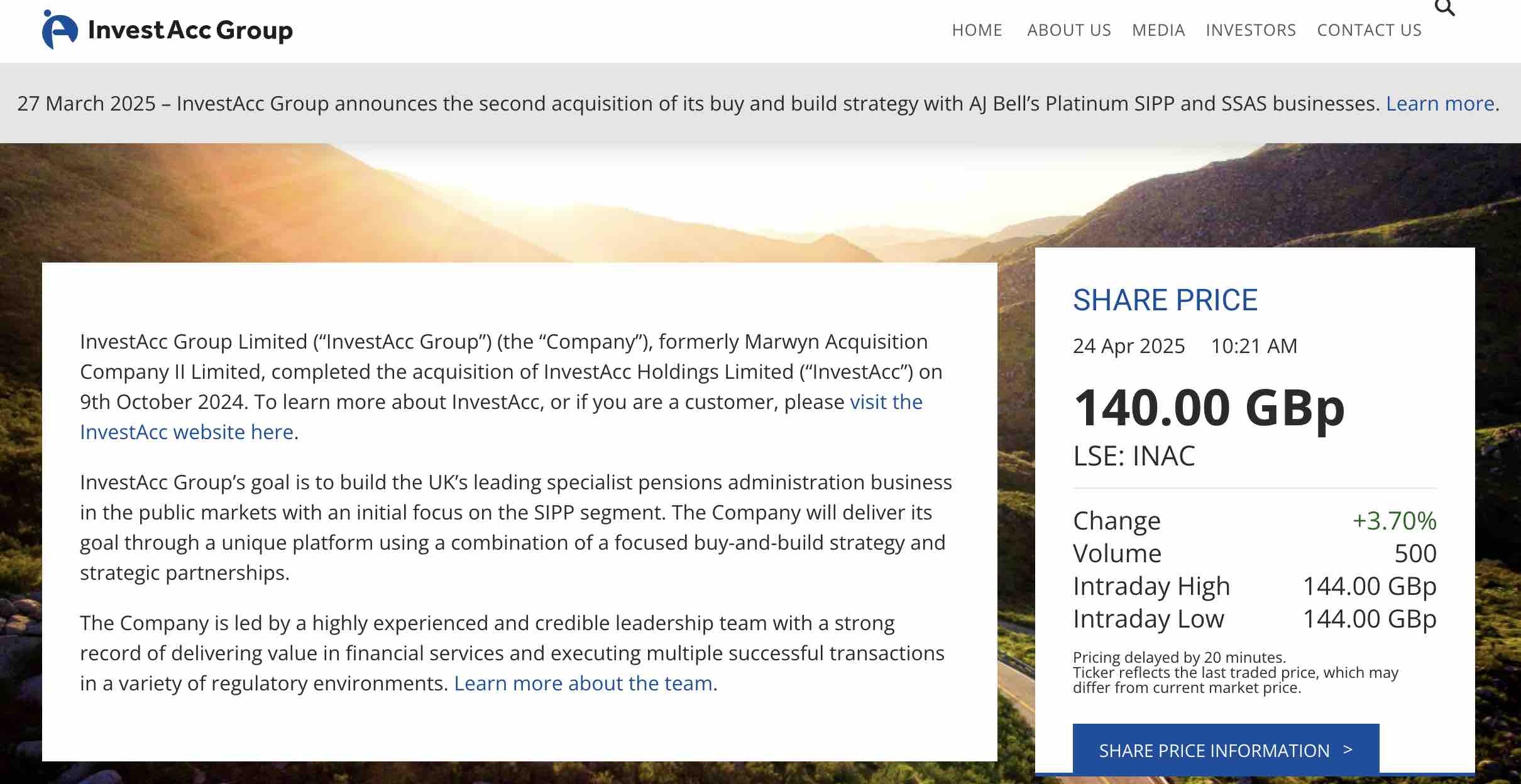

The company, formerly known as Marwyn Acquisition Company, changed its name to InvestAcc last October after acquiring the pensions administration business in a £41.5m deal.

Last month it agreed to buy AJ Bell’s Platinum SIPP and SSAS business for £25m, with the deal expected to complete in the second half of this year.

In a trading update published today it said trading profits grew 15.7% to £4.2m in the last six months of 2024, up from £3.7m.

The group posted an operating loss of £2.2m, after taking account of £0.5m depreciation/amortisation and £1.6m acquisition and integration costs.

It said it experienced a 17.7% SIPP organic customer growth in the period. The number of SIPPs it administered climbed to 11,974 at the end of 2024, up from 8,740 in 2022 and 10,177 in 2023.

Mark Hodges, executive chairman of InvestAcc Group, said: “Q1 2025 has been an exciting time for our organisation, with the announcement of the acquisition of the Platinum SIPP and SSAS businesses from AJ Bell at the same time as experiencing strong organic growth.

“With these foundations, we look forward to continuing our consolidation strategy, building a leading specialist pension administrator with a high-quality integrated business and a focus on excellent customer outcomes."

Looking ahead the company said: “The board remain positive around the wider M&A pipeline. The credibility, experience and momentum driven by the group's first two acquisitions has re-enforced the strength of the potential pipeline. Opportunities remain in all three target categories: specialist providers, life companies, and platforms, with over 100 providers in a fragmented market.”

InvestAcc Group was formerly known as Marwyn Acquisition Company II Limited. It completed the acquisition of InvestAcc on 9 October 2024 for £41.5m. Its buy-and-build strategy is to build the UK’s leading specialist pensions administration business in the public markets with an initial focus on the SIPP segment.

It said: "A push for higher levels of Consumer Duty and consumer care, as well as vendor needs are driving the UK SIPP sector to actively consolidate. Life companies and platforms account for over 80% of the simple SIPP market, but the full SIPP market - serviced by specialist firms - is much more fragmented. The fragmented supply side of the SIPP market creates a structural opportunity for inorganic growth.”