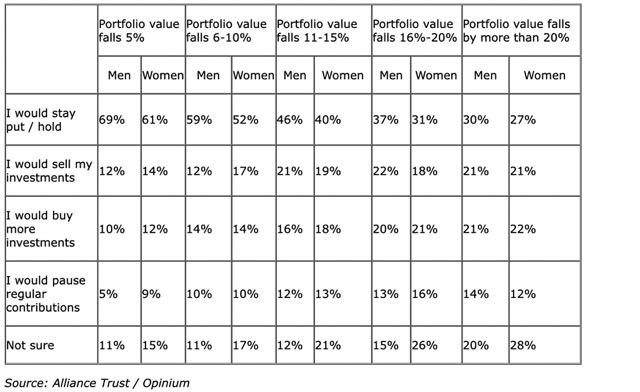

Women investors are more likely than men to hold their nerve during financial turmoil but are less likely than men to invest overall, according to a new study.

The research, for investment provider Alliance Trust, revealed that women were better at holding their investment nerve and less likely to have crystallised a loss when the market dipped.

However, the survey also revealed that men were more likely than men to invest, have more invested and twice as many men as women have a SIPP or an ISA.

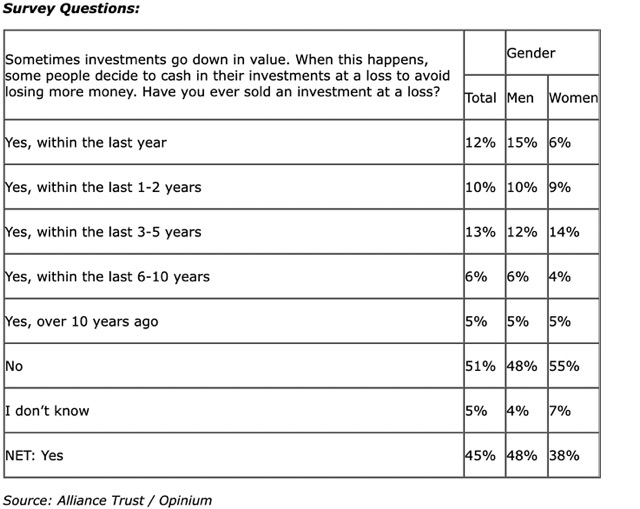

Women appear to be better at staying the course when investing. Almost half of men (48%) have sold investments at a loss when they have gone down to try to avoid losing more money but only 38% of women have done the same.

When asked whether they had stopped or reduced their regular investment payments because the markets had dropped, 17% of men had done so entirely compared to just 12% of women.

However, the survey also showed that men have more money invested compared to women and were more likely to invest in the stock market. Some 30% of men in the UK have a stocks & shares ISA compared to just 16% of women.

About 17% of men have a general investment account compared to 10% of women while 19% of men have a SIPP compared to 9% of women. Ownership of cash savings was similar.

Men also have more money invested with more than half of the women who do invest (54%) having less than £20,000 invested, compared to 37% of men.

In contrast, 39% of men have more than £50,000 invested while just 28% of women can say the same.

• Consumer research was conducted by Opinium Research, who surveyed 2,000 UK adults in August. Of these, 730 were investors (defined as having a Stocks & Shares ISA, a general investment account, and/ or a self-invested/ self-managed personal pension).