An estimated 7m say they know “nothing” about the pension revolution despite huge publicity and campaigns to promote the changes. The survey also found many mistaken beliefs about pensions.

The Aviva report found that 11m under-35s were “not confident” they will receive money from the state at retirement and 9m expect to receive a state pension before their predicted age for the state pension of 68.

Aviva has published the study to mark the two year anniversary of the new flat rate state pension and pension freedoms.

Aviva says that the pension changes have revolutionised the UK pensions landscape but its new research suggests that awareness and understanding among the public, particularly younger people, remains poor. Attitudes among the young also show considerable scepticism of finances generally due to soaring house prices, lack of job security, student debt and the decline of generous final salary workplace pensions.

One-third (35%) of 18-to-35 year olds believe that their generation has been priced out of the property market, and 18-to-35s typically carry more than £6,000 of debt with graduates expecting to wait at least 11 years before they will pay off their student loans.

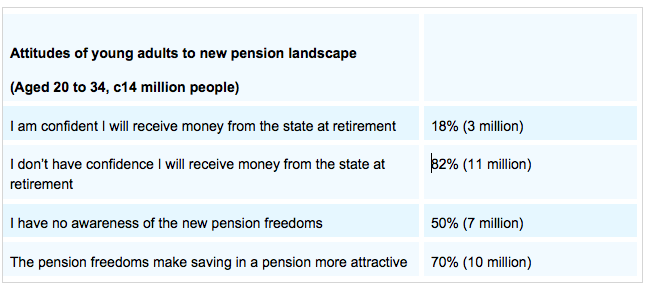

Fewer than one-in-five (18%) under-35s are confident they will get money from the state when they retire. Of the 14 million people aged 20-to-35 in the UK, four-in-five, or 11 million, were not confident they will receive the state pension at retirement. Among those who think that money from the state in retirement is at least still “possible”, only one-in-five (20%) are certain of the amount they will actually receive.

Current legislation says that the state pension age for those under 35 will be 68, yet Aviva’s research finds that two-thirds (65%) of this population believe they will receive it before this age.

On the positive side, when the freedoms are explained to theunder-35s, more than two-in-three (70%) believe the changes make saving into a pension a more attractive option.

Source: Aviva

Alistair McQueen, head of savings & retirement at Aviva, said: “As many as 14 million young savers today understandably see retirement as tomorrow’s problem. Yet the retirement challenges facing today’s under-35s are arguably greater than those faced by any recent generation. We need to reframe how we see this challenge and position it as a challenge for the young, not just the old.

"The internet is increasingly replacing friends and family as a source of help and guidance, yet the pensions world is often in the stone age in its adoption of technology. Aviva is keen to play its part in changing this - on our own, with developments such as MyAviva, and across our industry, with developments such as the Pensions Dashboard.”

“We need to encourage action among today’s young and ensure all concerned understand what lies ahead. If this greater understanding is translated into greater action there could be as many as 10 million more active young savers in coming years.”

Research was conducted through Censuswide with 1,316 consumers aged 20-55. Survey completed between 29-31 March 2017