The FSCS revealed the figures today in its annual report, stating that claims on average were £38,609, up from £29,505 in 2014/15.

Officials said the rise in Sipp related claims were to blame for an increase in the compensation bill against the life and pensions advice sector overall.

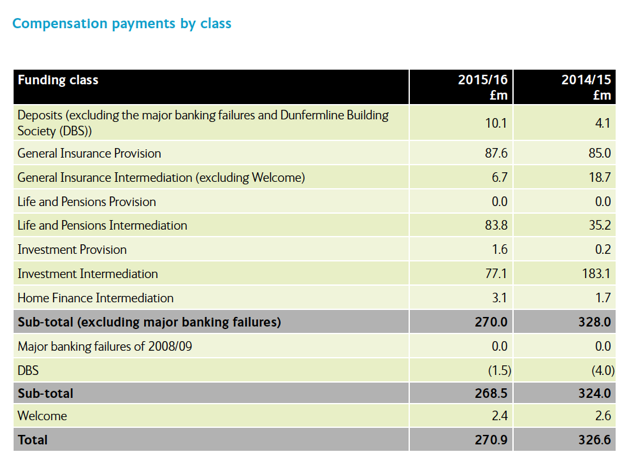

This rose to just less than £84m, up from £35m the previous year.

The report stated: “The FSCS continued to see high volumes of Sipp-related claims, involving advice given by financial advisers to invest in Sipps and to hold within these Sipps, investments in high-risk, non-standard asset classes, which have often become illiquid.

“This trend began in 2014/15, but continued during 2015/16, with claims against an increasing population of failed adviser firms. Over the year, FSCS paid compensation of just under £77m.

“FSCS’s experience of Sipp-related claims against advisers is consistent with alerts previously published by the Financial Conduct Authority in connection with the conduct of some firms involved in advising on pensions.”

Some £77m was paid out to people with claims against financial advisers that later stopped trading.

Almost £88m was paid to customers of firms providing general insurance – such as motor and employers’ liability insurance.

The cost of running FSCS is down by almost eight per cent, the organisation reported.

Management expenses were £66m in 2015/16, compared with £71.5m in the previous year.

In the past 15 years, FSCS has paid out more than £26bn in compensation to over 4.5m people.

Levies paid by the financial services industry to FSCS in 2015/16 totalled £1.09bn, compared with £1.08bn the previous year. Both figures include the interest cost and capital repayment levy for the banking failures in 2008/09, £454m and £697m respectively.

Tens of thousands of people got their money back last year, thanks to the Financial Services Compensation Scheme (FSCS), after companies offering financial services failed or stopped trading for some other reason.

FSCS paid out £271m in 2015/16 in response to 45,900 claims.

Some 47,000 people turned to FSCS in the twelve months to March 2016, after they lost money when their financial services firm was unable to settle claims.