There was a net 1.2% increase in the number of schemes being administered by 30 November, the interim results for six months showed.

The number of SSAS and Sipp schemes the group operates on an administration-only basis increased to 3,160 – up from 2,685.

Pension consultancy and administration revenues were up 1.2% to £7.61m from £7.52m, with an increase in fees driven by the total number of Sipp and SSAS schemes administered by the group increasing to 7,444 from 6,322 being offset by the fall in banking revenues during the period.

In recent years, Mattioli Woods has been appointed to operate or wind-up a number of distressed Sipp portfolios following the failure of the previous operator.

Lost schemes have included the transfer of members of these distressed Sipp portfolios to alternative arrangements, with lost schemes during the period being offset by 559 administration-only schemes being acquired as part of the Taylor Patterson and Lindley Trustees portfolios.

Overall, third party administration fees increased 31.4% to £1.55m.

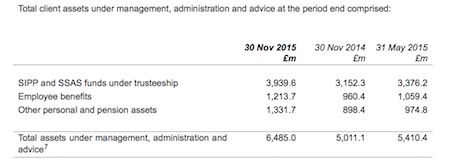

The firm also announced a £38.1m increase in other personal and pension assets under management and advice, with 154 new personal clients during the period.

There was a £30.5m fall in the value of assets held in those corporate pension schemes advised by its employee benefits business.

Overall, the revenue went up 20.0% to £19.90m and the net cash figure stood at £22.64m. Discretionary assets under management passed the £1bn mark, growing by over 24.1% to £1.08bn.

Ian Mattioli, chief executive, said more acquisitions were on the cards and believes further consolidation in the Sipp market remains likely, as the new capital adequacy rules take effect on 1 September .

He said: “In June 2015 we raised gross proceeds of £18.6m by way of a placing to allow us to pursue further acquisitions.

"Acquisitions continue to be a core part of our growth strategy and we anticipate there will be further opportunities to expand the group's operations by acquisition.

“The balance of funds raised by way of the placing gives us the flexibility to make further value-enhancing acquisitions."