Hargreaves kept open its phone lines on Bank Holiday Monday but says the number of call was relatively light at a "couple of hundred." The company says few people are asking about withdrawing all their pension funds in one go.

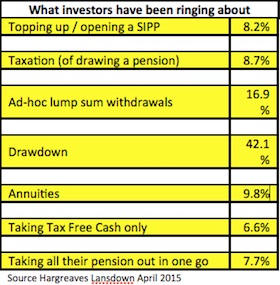

During the past year the most asked about topic was pensions drawdown, accounting for 42 per cent of calls, followed some way behind by ad hoc lump sum withdrawal at 16.9% of calls, annuities at 9.8% and topping up or opening a Sipp at 8.2%.

{desktop}{/desktop}{mobile}{/mobile}

The Bristol-based investment provider and Financial Planning firm said that investors have been calling about:

Tom McPhail, head of pensions research: "It will take some time for a clear pattern to emerge in terms of how investors are looking to use the new freedoms. However a couple of things are already immediately apparent. Investors saving with a pension company which doesn't offer a full range of choices are going to find themselves at a disadvantage and may have to move their money to get what they want.

"Initial demand has been focused on an investment income rather than buying an annuity, though we do expect this balance to swing back to some extent in the weeks to come. Relatively few people are asking to take all their money out; we'll be tracking the sums involved however in the main we expect it to be at the smaller end of pension pot sizes.

Mr McPhail added: "We remain concerned that the Government has not set in place a consistent industry-wide tracking system to monitor how these new freedoms are used by investors."