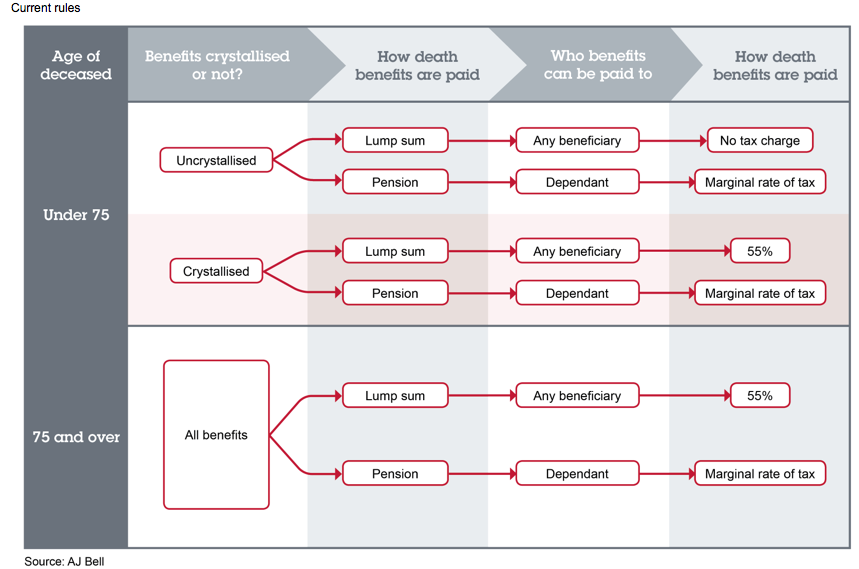

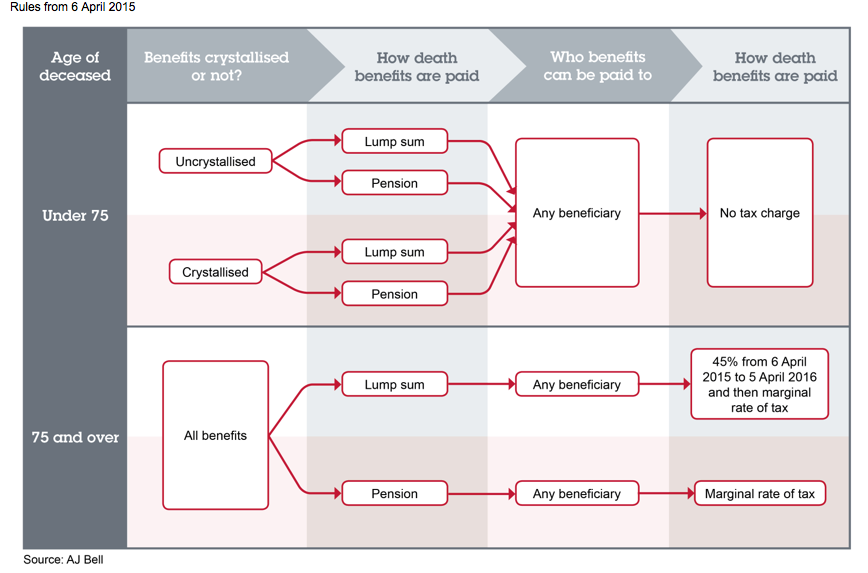

A Sipps firm has attempted to simplify the major announcement on death tax changes made this week by creating an explanatory graphic for use by advisers.

Investment platform provider AJ Bell has created the diagram setting out the current and post-6 April 2015 rules.

Scroll to bottom of story to view.

On Monday George Osborne announced significant changes to the tax charges applied to payments made from pension schemes following the death of the pension scheme member.

Andy Bell, chief executive of AJ Bell, was sceptical about the reasons for the move being announced at the Conservative party conference and doubts whether it will remain policy if a change of Government occurs at the May General Election.

{desktop}{/desktop}{mobile}{/mobile}

He said: "The Government has put pensions at the centre of its pre-election giveaway. What is concerning is that pensions once again become a political football. "In some ways the new rules look too good to be true and I have to question whether they would survive the first Budget of a Labour Government.

"The timing of the announcement feels like it has been arranged for political gain over carefully thought-out policy.

"Whilst I welcome the spirit of these changes it does feel like an area where a short consultation with the industry would have avoided potential problems that will come from the application of the new rules."

David Trenner, technical director at Intelligent Pensions, said: "The measure is to be welcomed, as it should encourage savers to put more into their pension funds, safe in the knowledge that the funds will now be accessible whether they die early or live for many years in retirement.

"For most people these new rules will increase the need for advice, and this advice may need to dovetail with Inheritance Tax planning for those with larger estates."