Aegon has found that the pension 'timebomb' has almost run out as consumers remain unprepared for retirement.

In its Retirement Readiness survey, the firm surveyed almost 2,000 people aged over 25 and found over 30 per cent of people over 55 are unaware of how much they will need in retirement.

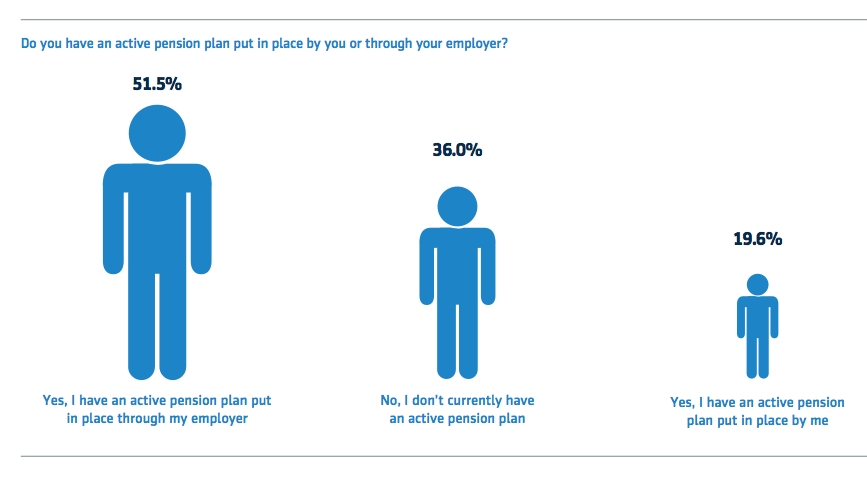

A further 30 per cent of people over 55 had no pension plan in place and 25 per cent were unaware how much income they will receive in retirement.

Some 66 per cent said they did not have a back-up plan in place if they were forced to stop work before retirement age.

The biggest pension shortfall was in Wales where 46 per cent of people had no personal or workplace pension.

Duncan Jarrett, managing director of retail and At-Retirement at Aegon UK, said: "Some of our findings are alarming to say the least with worrying levels of confusion, apathy and realism and we've also discovered some surprising regional trends.

{desktop}{/desktop}{mobile}{/mobile}

"Perhaps the most worrying finding of all is that these poor planning trends are evident in those closest to retirement, in the 55+ age bracket. Many industry analysts and the media have previously claimed there is a pensions time bomb ticking in the UK, but our study suggests time has almost run out."

However, Mr Jarrett said there were positive signs from younger generations who had time to make sufficient plans.

Over half of people aged 25-34 had a pension plan, 48 per cent had a good understanding of its value and 43 per cent had a good understanding of what they would receive in retirement.

Mr Jarrett said: "There are positive signs in the younger respondents as 25-34 year olds are demonstrating early signs of strong retirement planning and personal responsibility. There is huge room for improvement, but there are simple solutions for this important problem that can be adopted by anyone."

Pension 'timebomb' running out for over-55s approaching retirement