Displaying items by tag: ONS

Cost of living crisis driving retired over-50s back to work

Rising expenses from the cost-of-living crisis is the main factor driving retirees over 50 back to work, according to new data from the Office for National Statistics.

Nearly 9 in 10 early retirees mulling return to work

Almost nine in ten (86%) early retirees between 50 and 54 would consider a return to work as the cost-of-living crisis continues to hit their finances.

Men and women working for years longer than mid-90s

Women are, on average, working for nearly four additional years before exiting the labour market compared to the counterparts in the mid-nineties, new statistics from the ONS revealed this week.

State Pension may fail millions as life expectancy rise slows

Projections from the government's Office for National Statistics suggest that the rise in life expectancy over recent years is slowing down.

UK median wealth holds steady at £302,000

Median household net wealth held steady for the period April 2018 to March 2020 at £302,000, according to the latest figures from the Office for National Statistics.

Oldest kickstarted into retirement by pandemic

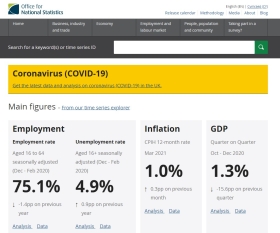

Today’s Office of National Statistics figures on the UK labour market showed it is the youngest and the oldest in the workforce who are most likely to have been made redundant as a result of the Coronavirus pandemic.

Self-employed trust property over pensions

Data from today’s Wealth and Assets Survey from the Office of National Statistics has shown that the self-employed continue to invest in property over pensions for their retirement.

DB transfers near £10bn in Q4 2019

Almost £10bn was transferred out of defined benefit pensions in the final quarter of 2019, according to official data.

Pension Freedom numbers head for peak

A record 1m more people will reach the Pension Freedom age of 55 his year and this ‘peak’ will last for several years, according to new analysis.

Auto-enrolment rises to record 77% coverage

A record 77% of UK employees were in a workplace pension in 2019, according to latest ONS figures released today.

This compares to only 47% in 2012 when auto-enrolment began and is the highest membership rate for workplace pensions since 1997.

ONS says participation in occupational defined contribution (DC) pensions has grown in recent years to the extent that more employees have a DC pension than other type.

The youngest employees, those aged 22 to 29 years, have seen the most growth in workplace pension membership since 2012, rising from 31% of younger workers enrolled to 80% in 2019.

ONS says that in 2019, the gender gap in public sector pension membership disappeared. In the private sector a gap still persists with more men (77%) having a workplace pension than women (69%).

In 2019, some 78% of employees with DC pensions contributed at least 3% of earnings, up from 37% in 2018. ONS says this is likely mainly due to minimum auto-enrolment contributions rising.

Eleanor Levy, director of Marketing and Communications at NOW: Pensions, said: “It’s fantastic to see that 77% of UK employees are members of a workplace pension scheme, and auto enrolment is at its highest membership rate ever. However, more still needs to be done to ensure that everyone has the ability to save for a successful retirement.

“While DWP’s pledge to lower the auto enrolment age to 18 is a great start, we must ensure that we maintain this momentum and scrap the £10,000 auto enrolment eligibility criteria which is penalising those who simply don’t earn enough. This criteria disproportionately affects women who work part-time while they care for the younger and older generations.

“We are very supportive of Baroness Jeannie Drake’s family carer top-up, which will help approximately three million women, in addition to 300,000 men, to top up their pension savings whilst taking time out of work to be carers.”