Displaying items by tag: survey

Third of Britons never reviewed retirement savings

Over a third (35%) of Britons have never reviewed their plans for retirement, with more than 29% admitting they do not expect to have enough money when they do retire, according to new research.

1 in 5 are rethinking retirement plans

The Coronavirus pandemic has forced a widespread rethink of retirement plans as 18% change their retirement age and 20% of over-55s have considered raiding their pension savings, according to a new report.

FCA launches Covid-19 survey of 13,000 firms

The FCA has today launched a survey of 13,000 regulated firms to assess how their ‘financial resilience’ may have been affected by the Coronavirus outbreak.

Slump likely for financial services - CBI/PwC survey

Financial services firms expect to be hit with a major drop in business in the next quarter due to Coronavirus, according to the latest CBI/PwC Financial Services Survey.

2 in 3 couples get no retirement planning advice

Nearly two out of three over-55s couples have never had retirement planning advice, according to a new survey.

More than half of workers ignorant of pension pot size

More than half of workers (54%) are ignorant about the size of their pension pots, according to a major survey by pensions industry trade body the PLSA.

Optimism picks up in financial services sector

Optimism in the financial services sector is improving at the fastest pace since June 2015, according to the latest CBI-PWC Financial Services Survey.

Clients most want help in achieving long-term financial goals

What clients most want from advisers is help in achieving their overall financial goals and maximising investment returns is a secondary consideration, according to an adviser survey.

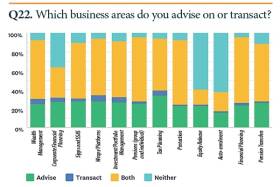

Survey reveals breadth of Financial Planners’ business

The responses from readers taking part in the latest Financial Planning Today survey demonstrated the wide variety of business areas that Financial Planners advise on and transact.

This is an edited section of the feature which can be read in full and for free here.

Predictably, the vast majority both advised and transacted Financial Planning services, close to 95%, but a number of other areas were handled by planning firms. Some 40% advised on or transacted auto-enrolment, equity release or corporate Financial Planning. Close to 95% said they transacted and advised on wraps/platforms and over nearly 95% did tax planning.

Some 91% transacted and advised on SIPPs and SSAS. Investment/portfolio management (91%) and pension transfers (88%) were also strongly represented.

However, some planners were unhappy with provider service in some areas.

One area of unrest appears to be in the service from platforms with more than one in five planners looking to change provider.

Some 6.7% of planners considered service levels to be “very poor” and said they were “actively seeking a new platform.”

The vast majority (65%) said platforms could do better.

Just 13% said the service they received was “excellent.”

Surprisingly, one area where planners appear to be taking a potential hurdle in their stride was regulation.

Despite the FCA’s recently announced major review of financial advice many viewed the review as positive.

Close to 70% said it was the right thing to do with 30% harbouring reservations.

This was despite more than 54% of respondents stating that financial regulation costs, including the FSCS and Financial Ombudsman, were a key challenge.

The main issue for many was the rising cost of professional indemnity insurance (58%).

This was followed by the FCA’s review of financial advice, competition from new and existing competitors (17.7%), competition from robo-advisers (10.8%) and sale or exit from business (9.5%).

Other answers included Brexit, MiFID II, increased market volatility and competing with unethical rivals.

The survey also showed the wide variation in the size of firms.

Many are still small with just one or two staff but there is growth among bigger firms, likely driven by a recent wave of mergers and acquisitions.

Marginally the second most popular answer (after one or two employees on 18%) was six to 10 employees at 17% of respondents, but this was closely followed by larger firms of more than 100 employees on 14.5%, tied with firms employing 11 to 25 staff.

The typical size of client portfolios varied greatly, with a range of less than £100,000 (9.5%) to £10m+ (1.3%).

The most popular answers were £350,001 to £500,000 and £500,001 to £1m (both 26%).

The next most popular answer was £250,001 to £350,000 (17.6%)

The vast majority expressed satisfaction with professional bodies like the PFS and CISI.

The full feature and survey results can be read for free here.